A Cap (Capitalization) Table, at the most fundamental level, is a record of all the equity that is owned by various entities (Founders, employees, consultants, investors etc) in the company. It is very important that you keep an accurate record of the equity ownership by various entities at all times. Most investors will ask for a cap table when you go to seek funding and it will determine the per share price that will be used in the financing.

Note that in calculating your ownership in the company, you should do so on a “fully diluted basis” i.e. taking into account your option pool as well as any warrants that have been issued. The share price for any financing will also be calculated by dividing the pre-money valuation by the fully diluted number of shares.

An Entrepreneur’s Journey

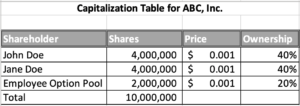

To understand how cap tables work, let’s follow the funding journey of a hypothetical company, ABC, Inc started by John and Jane Doe through Series A funding. John and Jane decide to split their stake 50/50. In addition, they set aside an option pool of 20% for their employees. They also decide to set up the company with a total of 10 million shares with a par value of $0.001 per share which is pretty typical. The cap table will now look as follows:

Seed Round

Now let’s say the company raises a Seed round of $500,000 from a seed VC firm Vista Capital as a convertible note with a valuation cap of $4,000,000 and a 20% discount to the next round. This means that when the company raises a Series A, the valuation that the Angel investors will get for their shares will be the lower of $4,000,000 or 80% of the share price paid by the Series A investors. Since no new shares were issued at this stage, the Cap table remains the same.

Series A Funding

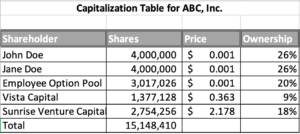

Now imagine that the company is doing well and has reached a milestone of $1 million ARR (Annual Recurring Revenues). This is typically the milestone that most VCs will consider funding a company. The company gets a term sheet from Sunrise Venture Capital to fund the company with $6 million in funding at a pre-money valuation of $24 million. The term sheet also stipulates an employee option pool of 20% post-funding.

Since the term sheet requires an employee option pool of 20% post-funding, the Employee option pool will need to be increased by another 1.0 million shares. This results in a total number of shares of 11 million prior to funding. The share price for the Seed investor will be calculated as $4,000,000/11 million shares = $0.36 since they have a $4,000,000 valuation cap which is lower than 80% of $24 million. On the other hand, the share price for the Series A investor will be calculated as $24 million/11 million shares = $2.18. The resulting cap table looks as follows:

Note that the common shares owned by John and Jane Doe and the Employee option pool are still listed as $0.001 which is not quite correct. Post funding, the Company will need to do a 409A valuation to determine a new valuation of the common shares. The common shares will have a value that will be significantly less than that of the preferred shares issued to investors since they have many preferences and rights that the common shareholders don’t have. For example, they typically have a liquidation preference where they get their money first in the event of a sale and if the sale price is not high enough there may no distribution to common share holders.

There are many tools available like Carta and Capshare to manage your equity. However, in the initial stages it will be sufficient to manage your cap table using a simple spreadsheet.

……………………………..

If you liked this article, check out my book that covers all aspects of the entrepreneurial journey.